What the badge means

Why this matters

Many consumers tell researchers they want to work with advisers who:

• listen carefully to their priorities

• explain recommendations in plain language

• tailor conversations to what matters to them

But there’s no easy way for consumers to see which firms actually do this well.

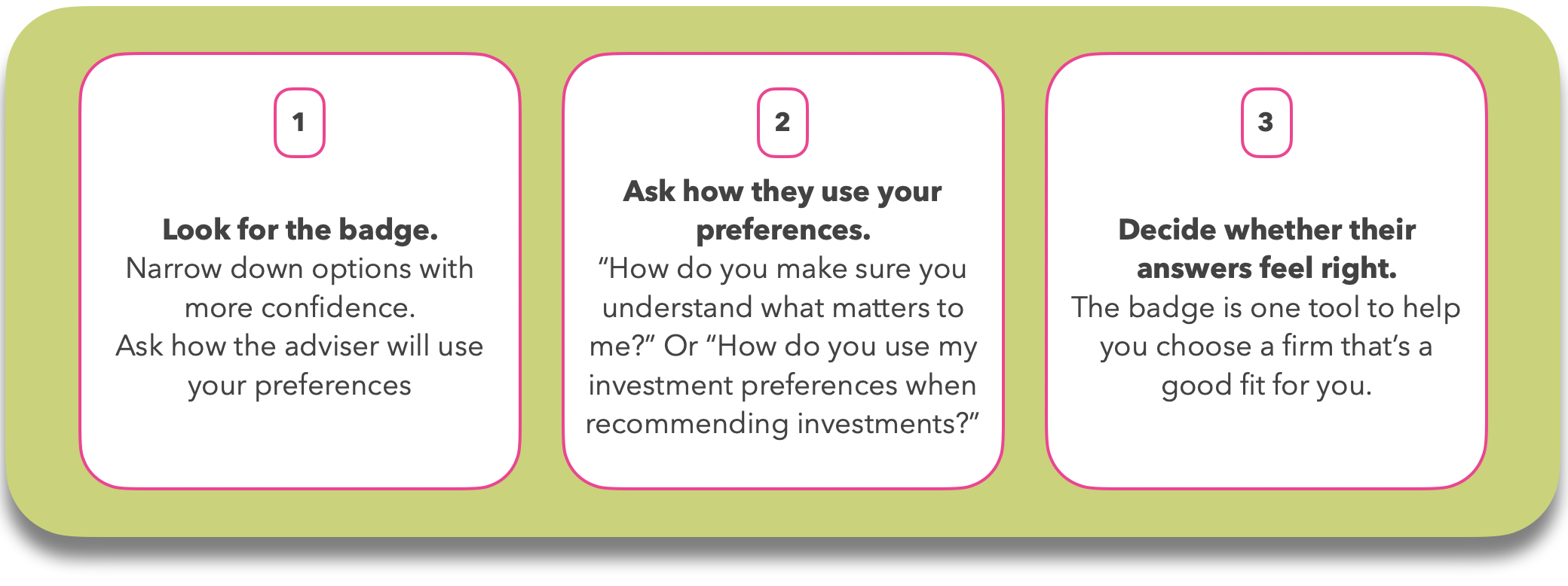

I am looking for financial advice on my investments now. What should I do?

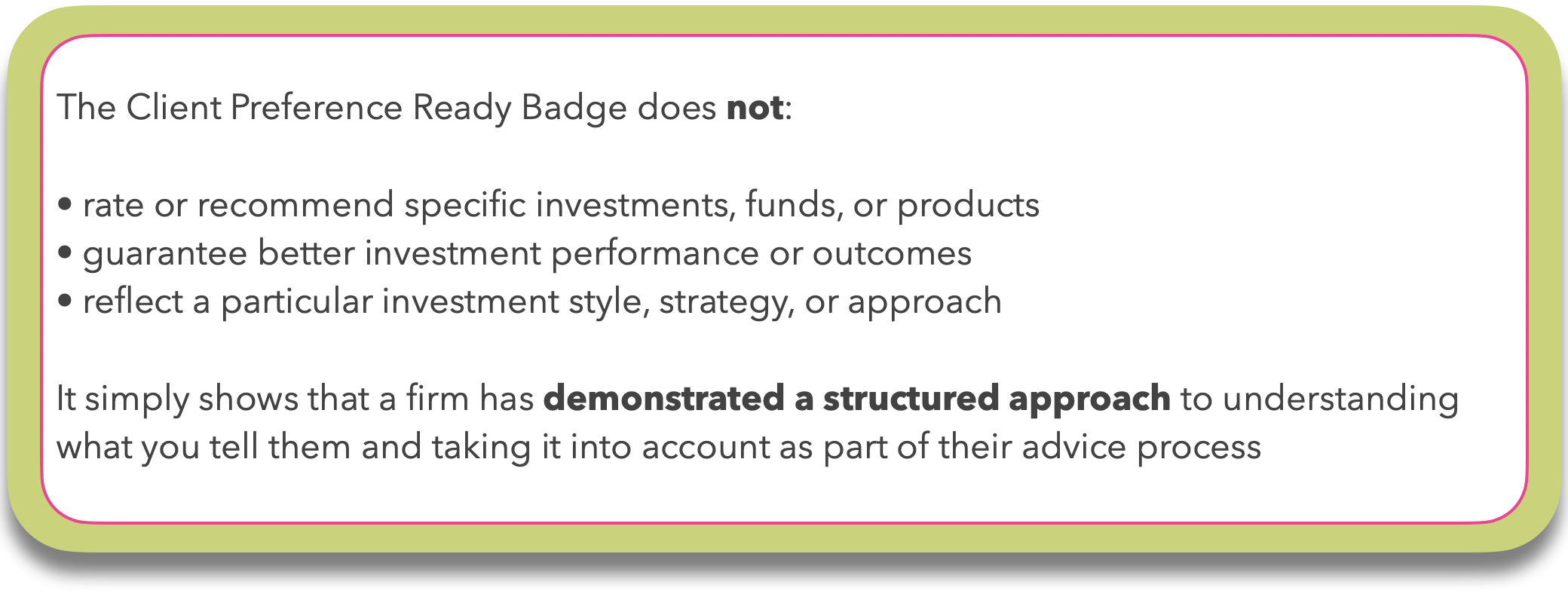

Important: What the badge does NOT tell you

Where to see this badge

How the badge is awarded

Any financial advice firm can apply for the badge. The Client Preference Ready Badge is an independent, voluntary standard run by In ACCORD.

The assessment looks at whether a firm:

• routinely asks all investment advice clients about their preferences

• has clear processes for recording them

• considers preferences within suitability discussions

• applies this approach consistently across the firm

The assessment is based on published criteria and is not a rating of investment products or performance.

Financial Advisers don’t pay to use the Badge – they earn the right to use it.

Want to learn more?

The Client Preference Ready Badge is an independent, voluntary standard run by In ACCORD.

In ACCORD is not a regulator and does not provide financial advice.

These links help you understand how the badge works and what it signals.

• Find out what this badge means for advice firms. Here

• About the standard and criteria – read the published methodology. Here